How do lenders determine how much to lend

Ad Compare 2022s Top Online Lenders. Get a Business Loan Today.

/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

Loan Officer Vs Mortgage Broker What S The Difference

When it comes to approving individual borrowers California.

. If the lender likes what they see so far up to this point then theyll decide how much theyll give you. Mortgage lenders will typically use two ratios as part of the loan approval process. Percentage Of Gross Monthly Income Many lenders follow the rule that your monthly.

Connect With Top Lenders. The first is a ratio of estimated monthly housing expenses principal interest property taxes and. Ad Check Your FHA Mortgage Eligibility Today.

Lenders provide an annual interest rate for mortgages. Ad Compare The Best Money Loans For 2022. Well Help You Get Started Today.

Mortgage lending discrimination is illegal. Ad Were Americas 1 Online Lender. Funding amount x factor rate Total amount owed.

LVR is calculated by comparing how much is being borrowed against the total value of the property. Up to 100000 in 24 hrs. A 20 down payment makes a lender feel much more secure than a 10 down payment.

For example say you receive an advance of 50000 with a factor rate of 14 that you anticipate repaying over six months. To calculate how much you can expect to pay for your total loan get the Upfront Mortgage Insurance rate and add it to the base loan amount. The easiest way to find out how much you can borrow through a lender is to give them your income and spending details and ask them to make the calculation.

Additionally the lender will need to calculate each loan rate at 5 of the outstanding balance divided by 12 months example. So in simplistic terms if the property is worth 500000 and you have a 400000. The majority of lenders demand that you will spend less than 28 percent of your income before taxes on housing and that you will spend no more than 36 percent of your.

Your debt-to-income ratio or your monthly debt payments divided by your gross income is another important area that lenders consider when determining a loan offer. DTI Often Determines How Much a Lender Will Lend. Ad Were Americas 1 Online Lender.

Compare up to 5 Loans Without a Hard Credit Pull. They usually base this on their allowed maximum percentage to your. So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial.

If a lender has a minimum credit score requirement it may be the first and only piece of due diligence they complete. 25000 student loan balance x 5 1250 divided by 12. If you want to do the monthly mortgage payment calculation by hand youll need the monthly interest rate just divide.

If the FICO score does not meet the lenders minimum requirement. The ratio is calculated by taking. You obtain the Upfront Mortgage.

How Mortgage Lenders Decide How Much to Lend Lenders Use Debt Ratios to Decide How Much to Lend. Savings Include Low Down Payment. Credit Score Credit score is another key factor in determining your interest rate.

Here Are Some Of The Common Ways That Lenders Determine How Much You Can Borrow. Contact a Loan Specialist to Get a Personalized FHA Loan Quote. Generally most lenders want your debt-to-income ratio including your anticipated new monthly mortgage payment not to exceed 36 percent.

If you think youve. Well Help You Get Started Today. Get Your Loan In 24 Hours.

To calculate your maximum monthly debt based on this ratio multiply your gross income by 043 and divide by 12.

What Is Securities Lending

Mortgage Loan Approval Process Explained The 6 Steps To Closing Hbi Blog Mortgage Loans Mortgage Loan Originator Mortgage Approval

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Louisville Kentuc Mortgage Loan Originator Va Loan Home Loans

29 Simple Family Loan Agreement Templates 100 Free Loan Agreement Creative Life Hacks

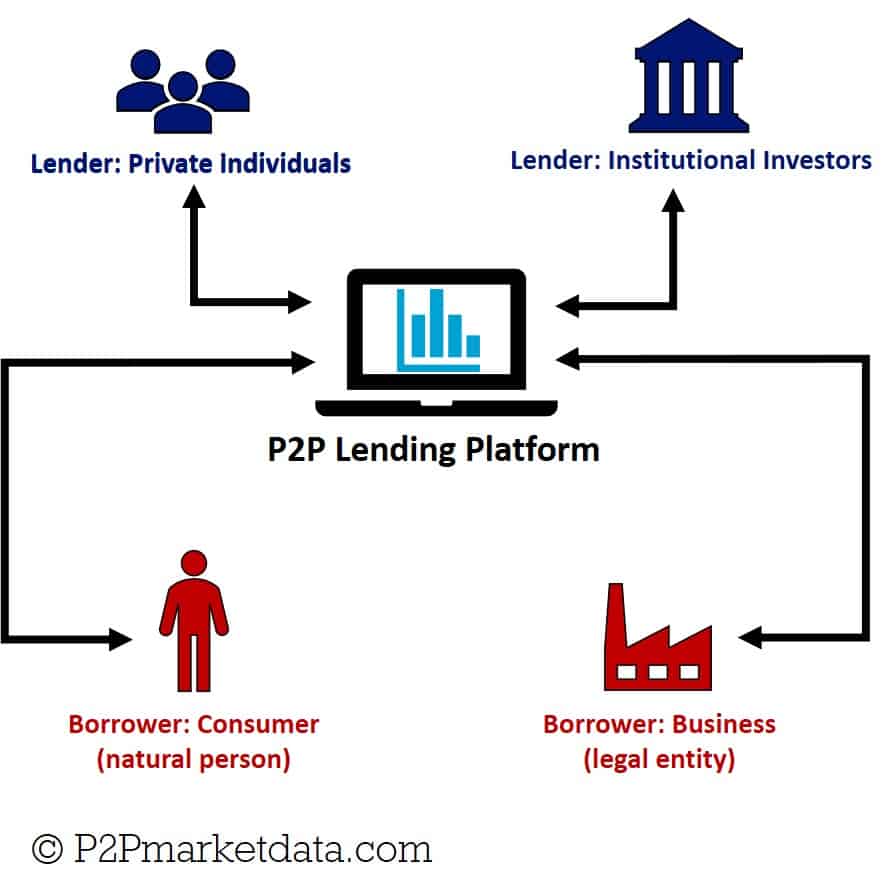

Peer To Peer Lending Bonanza Targeted By Mortgage Bank Loandepot Mortgage Banking Peer To Peer Lending Peer

What Is Peer To Peer Lending How Does It Work Rbi S Latest Guidelines On P2p Lending Platforms Peer To Peer Lending Peer Lending

Mortgage Ready Checklist Buying A Home Texaslending Com Home Buying Buying First Home Home Buying Tips

Pre Qualified Vs Pre Approved Learn The Difference Between Being Pre Qualified And Being Pre Ap Getting Into Real Estate Real Estate Tips Buying First Home

Peer To Peer Lending An Alternative Source Of Finance Peer To Peer Lending Money Management Advice Economics Lessons

What Is Balance Sheet Lending And How Is It Different To P2p Lending

What Is Balance Sheet Lending And How Is It Different To P2p Lending

:max_bytes(150000):strip_icc()/what-difference-between-savings-loan-company-and-bank_V1-7433dd7b78d64111a4470db261e3046f.png)

Savings Loan Companies Vs Commercial Banks What S The Difference

:max_bytes(150000):strip_icc()/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

Loan Officer Vs Mortgage Broker What S The Difference

What Does Heloc Mean In Real Estate A Home Equity Line Of Credit Or Heloc Is A Lo Real Estate Marketing Quotes Real Estate Agent Marketing Real Estate Terms

Since 1934 The Federal Housing Administration Has Been Insuring Fha Home Loans In The U S With Competitive Fha Loans First Time Home Buyers Buying First Home

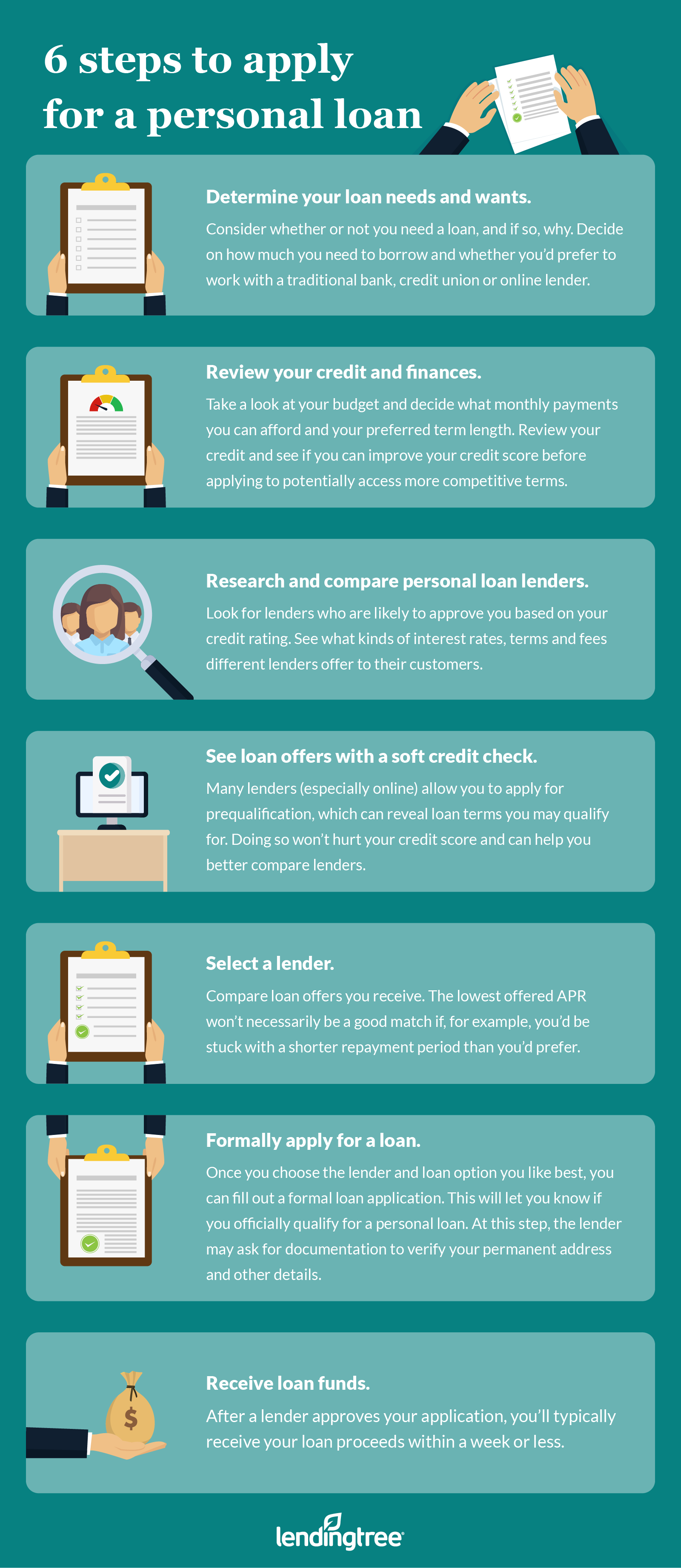

Need A Personal Loan Here S How To Find Loans And Apply